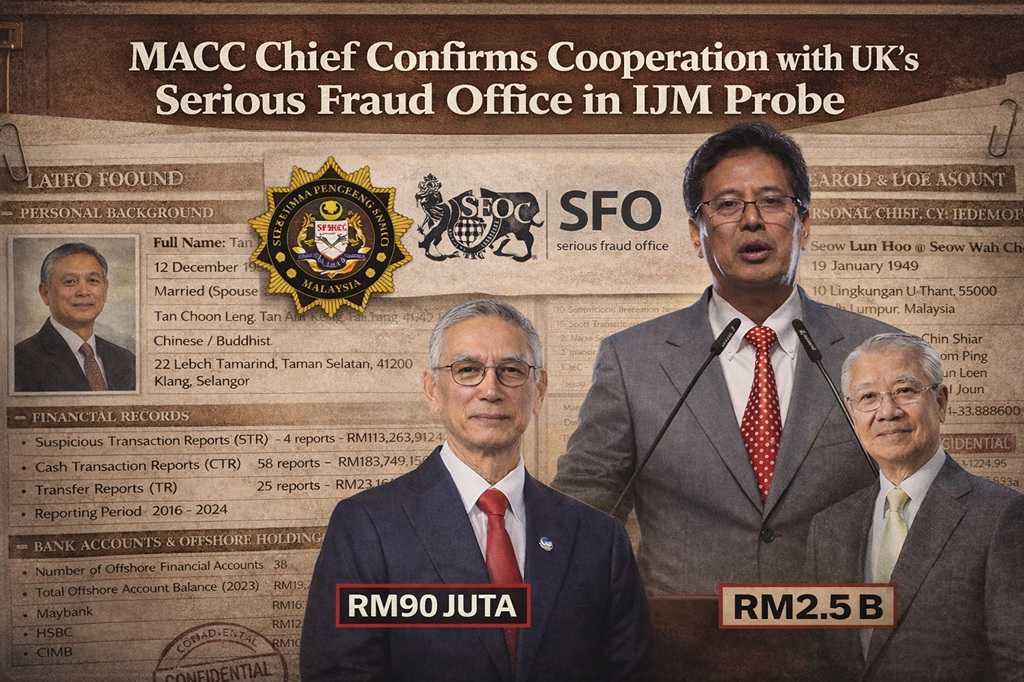

KUALA LUMPUR — Malaysia’s anti-graft agency has confirmed that it is working with British authorities in its investigation into alleged money-laundering activities involving IJM Corporation Bhd, with the probe now extending across borders.

Malaysian Anti-Corruption Commission (MACC) Chief Commissioner Tan Sri Azam Baki said on Thursday that the commission’s investigation into an alleged RM2.5 billion (US$617 million) money-laundering scheme linked to IJM has received formal cooperation from the United Kingdom’s Serious Fraud Office (SFO).

Azam said the investigation involves active information-sharing with the SFO, following multiple requests from UK authorities, in line with MACC’s role as Malaysia’s lead enforcement agency for corruption, abuse of power and financial crimes.

“When foreign jurisdictions conduct investigations, we must also play our part and extend full cooperation. This matter is being given due attention,” Azam told reporters.

On the progress of the probe, Azam said no new information has been obtained thus far, but investigations remain ongoing. He confirmed that MACC intends to record statements from IJM chairman and chief executive officer Tan Sri Krishnan Tan as part of the inquiry.

Azam added that investigators require additional time, as the alleged offences are believed to date back to 2015 or 2016.

“This is an old case. There are many elements that need to be traced and verified, including specific transaction details, before any further action can be taken,” he said.

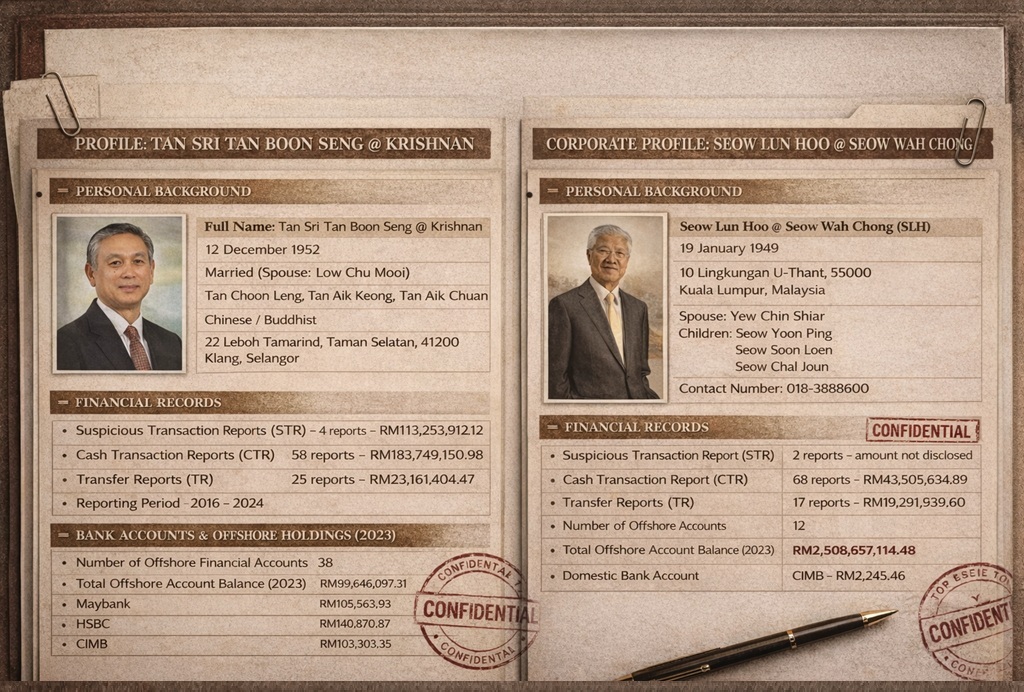

Earlier reports indicated that the UK’s Serious Fraud Office had launched its own investigation into alleged money-laundering and corruption linked to multi-billion-ringgit investment transactions involving Tan Sri Krishnan Tan and his close associate, Seow Lun Hoo @ Seow Wah Chong. Both individuals are also reportedly being examined over allegations of share-price manipulation.

Previous disclosures alleged that Tan Sri Krishnan Tan controlled up to 38 offshore bank accounts holding approximately RM90 million, while Seow Lun Hoo is said to have held 12 offshore accounts containing funds estimated at RM2.5 billion. These claims have yet to be tested in court.

The controversy surrounding IJM intensified earlier following public opposition to a proposed corporate merger involving the group. Critics, including the Malay Chamber of Commerce and UMNO Youth chief Datuk Dr Akmal Saleh, warned that any takeover could undermine Bumiputera ownership in IJM, where government-linked investment companies (GLICs) currently control more than 50% of the shareholding.

Akmal’s intervention reignited public scrutiny over GLIC stakes in IJM and the strategic importance of the group’s assets, including four toll-road concessions and Kuantan Port.

Notably, the MACC’s move to formally investigate IJM came months after international reports first surfaced in August last year alleging that Tan Sri Krishnan Tan was already under scrutiny by the UK’s Serious Fraud Office — revelations that had previously been dismissed by some quarters before gaining renewed attention following the commission’s confirmation.